Can be converted into cash. Used to acquire non-current assets for the company.

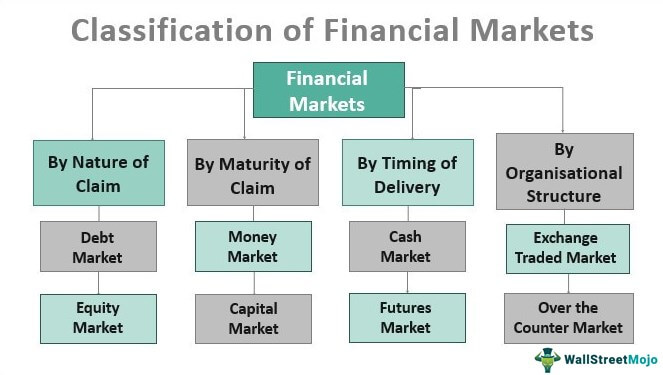

Classification Of Financial Markets 4 Ways To Classify Financial Markets

Used to acquire current assets for the company.

. Link between Savers and Investors. The Indian capital market is the market for long term loanable funds as distinct from money market which deals in short-term funds. Financial markets help people to invest their savings in various financial instruments and earn income and capital appreciation.

Financial Management is the activity concerned with the control and planning of financial resources. Income is the flow of money obtained from factors of production. It is plays a central role in the settlement function.

Examples of functional budgets include budgets for functions such as production sales business development and materials purchasing. In contrast the capital market is used for long-term assets ie assets which have a maturity of more than one year. Financial accounting intends to disclose the correct information to the stakeholders enabling them to make informed decisions.

In fact money is a type of financial assetone that is highly liquid used to make payments but that typically pays little or no interest. Finance is the lifeblood of business without it things wouldnt run smoothly. Both Financial accounting and management accounting are important branches of accounting.

The money market is less risky than the capital market while the capital. The money market Money Market The money market is a financial market wherein short. It has also led to the creation of financial institutions.

From a technical perspective the capital structure is the careful balance between equity and debt that a business uses to finance its assets day-to-day operations and future growth. On the other hand wealth is the market price of the stock of asset possessed by an individual or household. Of course money is used to purchase various factors such as raw materials machinery labour which help to produce goods but money itself does not directly help in the production of goods.

FUNDS Owners funds Borrowed funds. Fixed capital is not at all liquid. They act as half-way houses between the primary lenders and the final borrowers.

The money market and the capital market are the two different types of financial markets wherein the money market is used for short-term borrowing and lending. Income is earned or received during a limited period. In this way it facilitates and promotes the process of economic growth in the country.

Money is a convenient mode of calculation and payment of interest amount to be paid in the future. Like any form of organized economic activity health care organizations need financial capital to carry out their functions. 1Mobilization of savings and channelising them into the most productive uses.

In business the finance function involves the acquiring and utilization of funds necessary for efficient operations. Money is used to settle transaction. Ii Store of value.

In principal capital market loans are used by industries mainly for fixed. It refers to the facilities and institutional arrangements for borrowing and lending term funds medium term and long term funds. Typically the local currency is the entitys functional currency.

Conversely wealth is accumulated over time ie. Functional budgets address spending and revenue for a particular function -- such as a department or process -- within a business. Not possible to convert into cash.

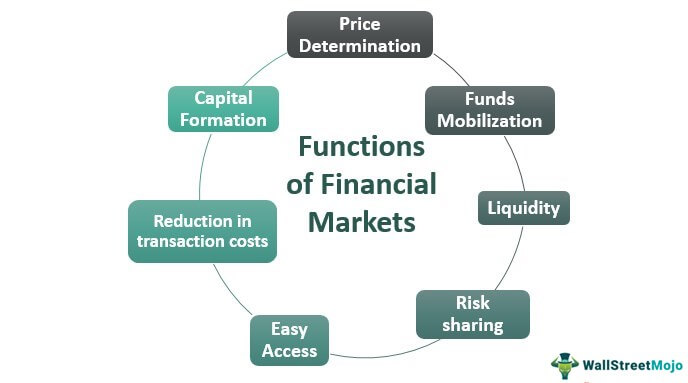

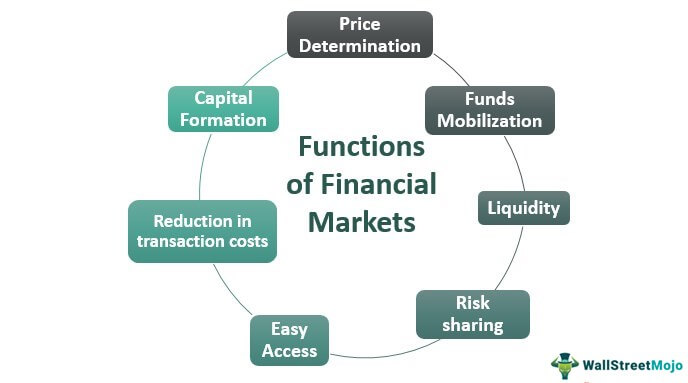

A store of value implies a store of wealth. Owners funds Equity share capital Preference share capital reserves. Functions of Financial Market.

Finance or cap Money is physical coins and bills that have some value. The Finance Function is a part of financial management. Capital Structure is the mix between owners funds and borrowed funds.

Since many easily confuse the two types of assets to be of similar meaning the following article provides a solid explanation of the difference between the two and explore a few points that may help readers understand the difference between these two types of assets. It is the currency in which an entity generates and expends cash. The difference between financial and management accounting is an important concept to study since both terms are different.

The money which is available for investment and productive purposes has been called money capital or financial capital by some economists. The line between money and financial assets is not always clear. Working capital is highly liquid.

Investors buy them to share in that growth. Functional expenses are reported by their functional classification and recorded in a Statement of Functional Expenses. A Guide to Nonprofit Accounting.

The national currency of the country where the foreign firm is operating is called the local currency. They accept deposits from the public and pay deposit rates to it. The creation of wealth takes time.

Money is physical coins and bills that have some value. Financial intermediaries generally include commercial banks cooperative credit societies building societies insurance companies etc. Here are some key nonprofit accounting principles to help you understand functional expenses.

Companies issue stocks and bonds to raise money to grow their businesses. Difference Financial Intermediaries. Capital market plays an important role in mobilising resources and diverting them in productive channels.

But finance is about how to manage money to use it efficiently. The financial intermediaries obtain. Various functions and significance of capital market are discussed below.

This method of expense reporting is most commonly used by nonprofit organizations. 11 Other types of financial assets are less liquid but offer the potential to. The capital market functions as a link.

The functional currency can be the local currency or some other currency. Facilitates transfer of savings from the savers to the investors. 2 Before an organization can provide services or undertake a new program it must use financial capital to purchase or rent space equipment supplies labor and so forththat is to prepay for certain inputs used in the production of.

Budgets are used by management to control spending and manage the growth of a business. This function has facilitated borrowing and lending.

Capital Asset Pricing Model Capital Assets Modern Portfolio Theory Financial Asset

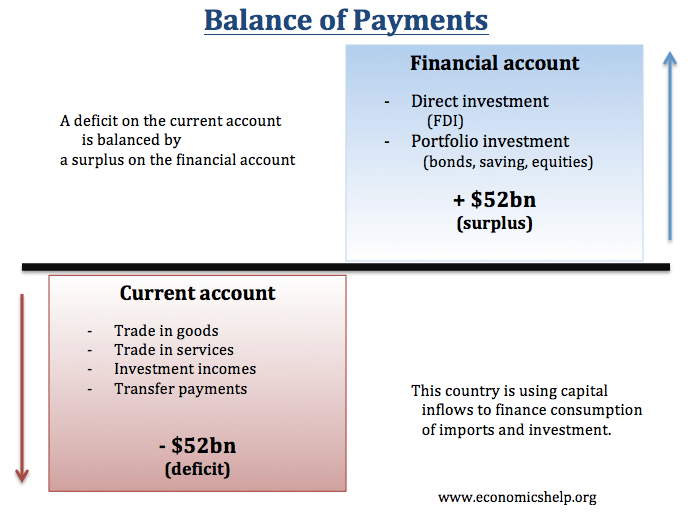

Current And Financial Account Balance Economics Help

Functions Of Financial Markets List Of Top 7 Financial Market Functions

0 Comments